Life Insurance Lessons From the Community Chest

Insurance: Discovering the real value of life insurance policies.

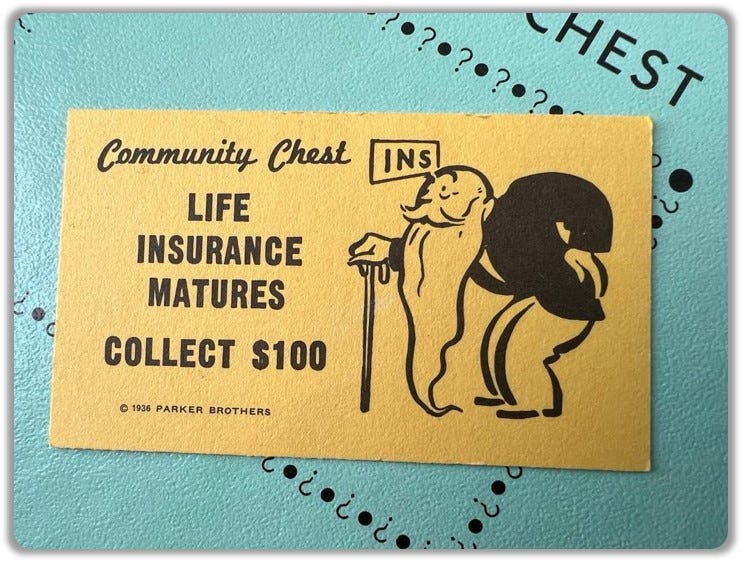

Remember the (now retired) Monopoly Community Chest card with a long-bearded Milburn Pennybags that declares, “Life Insurance Matures – Collect $100”? This little yellow card unexpectedly holds a lesson about real-life insurance policies, something I’ve been thinking about since we released our new insurance workflows in Stronghold.

The $100 a player receives from this card is enough to pay the unexpected cost of landing on another player’s property, a great benefit that requires nothing more than a roll of the dice. However, in real life, in order to keep your policy in force (and to receive the benefit of it), you have to continue paying your monthly premiums, which is something this Community Chest card assumes that you’ve done. Unfortunately, millions of Americans stop paying their life insurance premiums every year, and don’t receive the full benefit of their policies.

Why do people let their policies lapse?

To better understand why people sopt paying their premiums and let their policies lapse, I asked my good friend Aaron Brask, a financial planner. Aaron and I met when I was a young lawyer, and he was a young banker, both working in London’s financial district. Since then, I’ve always enjoyed learning from Aaron about finance, and he’s always been extremely generous in sharing his Jedi-like knowledge of finance with me.

Aaron explained to me that most people set up life insurance policies that have fixed payments, where the premium paid each month is a fixed amount, like a mortgage. People abandon policies for different reasons. This could include anything from financial hardship to forgetting to make payments. However, these situations, whether by choice or not, lead to suboptimal outcomes for the policyholder.

The value of an insurance policy might not be clear to the average policyholder, because their monthly payments are often fixed. Even though the monthly premium remains the same, the policy becomes more valuable the older you get (at least according to actuaries).

Thinking about it another way, the insurance companies could charge you increasingly higher premiums as you get older, but insurance policies could become unaffordable for the elderly. The early years are effectively subsidising the later years so why would you walk away from the policy in the later years?

If this value proposition isn’t convincing, and you’re still considering abandoning your insurance policy, Aaron tells me that there are other options that many people aren’t aware of that may enable you to retain some of the value of a policy that you no longer want. You may be able to restructure your insurance policy so that it makes more sense for you or you may be able to sell it. That’s right, the terms of life insurance policies are not necessarily written in stone, and there is actually a market where investors will buy life insurance policies from you.

Learnings from the Community Chest

The Community Chest card’s message about life insurance is more than a historical feature of Monopoly; it’s a reminder of the potential benefits of life insurance and the importance of maintaining it. I took this to heart in designing our insurance workflows in Stronghold to make it simple to organise and access important information needed to maintain insurance policies.

Beyond using Stronghold to keep essential insurance information and important contacts organised, here are some strategies to keep your policy up to date:

Regular Reviews: Regularly review life insurance policies to ensure they’re up-to-date.

Understand Your Policy: Knowledge is power. Understand the terms, benefits, and premiums of your life insurance policy.

Open Discussions: Talk with family members about their insurance plans, maybe over a game of Monopoly?

Seek Professional Advice: Consult with a financial professional who will give you objective advice.

Final Thoughts

Remember, life insurance is not just about the payout; it's about the peace of mind and security it provides for you and your loved ones. So next time you pass 'Go' and collect $200, remember to review your life insurance policy, and just maybe the spirit of Milburn Pennybags (along with your financial advisor, of course) will guide you and your loved ones towards a more secure financial future.

Disclaimer: This blog post is available for general informational purposes only and does not constitute professional, legal, financial, or insurance advice. Do not rely on this blog post to make any financial, legal, or insurance decisions. Consult with a professional prior to making any legal, financial, or insurance decisions.