Investing in rental properties can be a lucrative way to build long-term wealth and generate passive income. This comprehensive guide will walk you through the process, covering key topics such as financing options, calculating ROI, and practical tips for success.

Understanding Residential Property

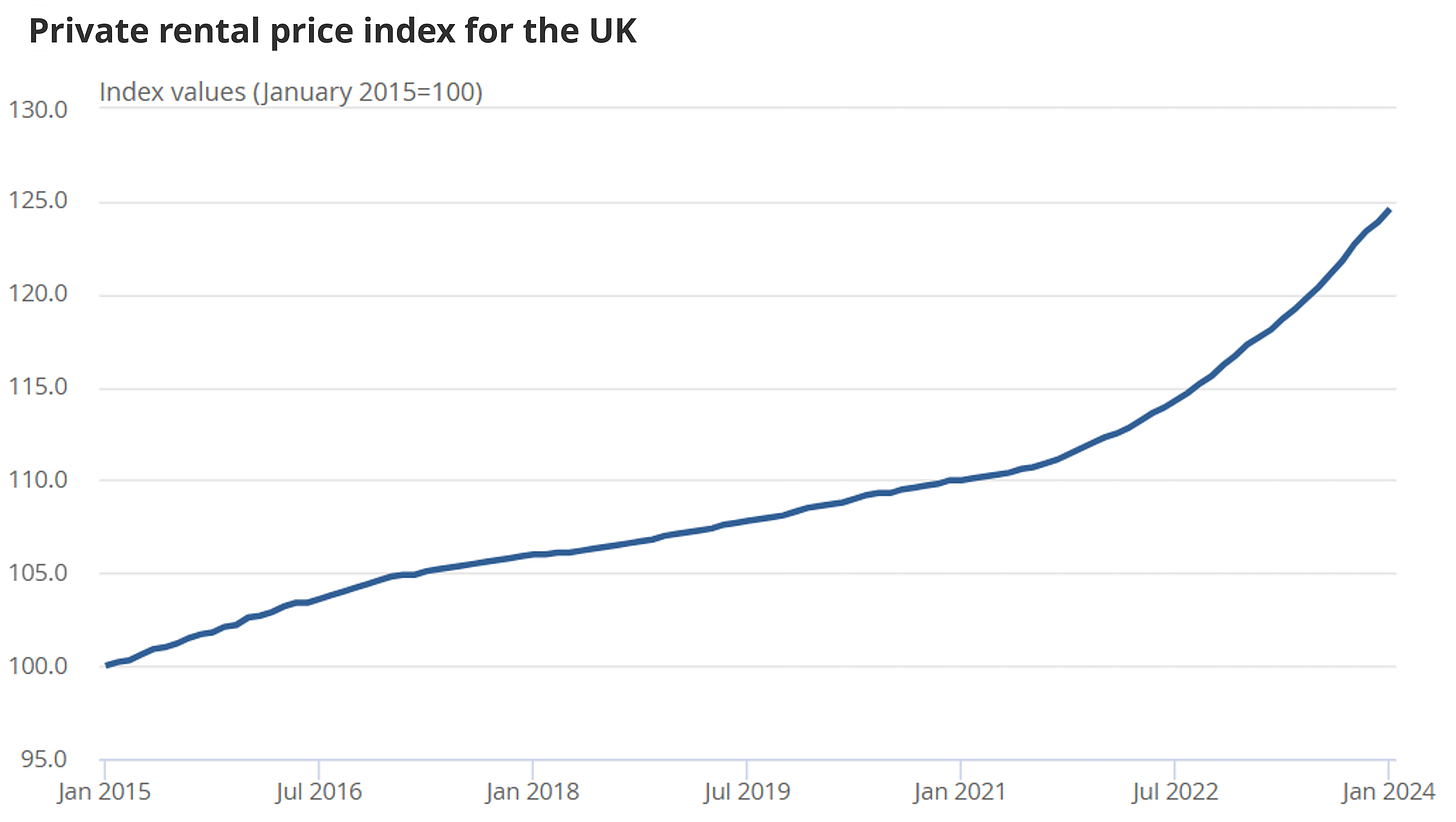

Residential properties, including single-family homes, multi-family homes, and flats, are popular choices for investors. The UK rental market has seen significant growth, with increasing demand for rental properties, particularly in London. There are about 8.6 million households in the UK that rent their home, and the rental market has grown substantially over the past few decades. In 2001, only about 10% of homes in England were privately rented, but by 2022 this had increased to around 19%. Understanding the market dynamics is crucial for making informed investment decisions.

This trend towards renting reflects various factors, including rising house prices, stricter mortgage lending criteria, and changing lifestyle preferences among younger generations. The data suggests that "generation rent" has become an increasingly significant demographic in the UK housing market, contributing to the rise in rental prices across the UK.

Rental Property vs. Second Home

When applying for a mortgage, it's essential to distinguish between a rental property and a second home. Rental properties typically require a larger deposit (25% or more) and have higher interest rates compared to primary residences. Second homes also come with different tax implications and financing requirements.

Pros and Cons of Buying Rental Property

Advantages

Steady Rental Income: Rental properties can provide a consistent income stream.

Capital Appreciation: Property values can appreciate over time, boosting your investment's worth.

Tax Benefits: Various expenses, including mortgage interest, repairs, and maintenance, can be deducted from your rental income.

Portfolio Diversification: Property can diversify your portfolio, reducing overall risk.

Disadvantages

Tenant Management: Dealing with tenants can be time-consuming and stressful.

Maintenance Costs: Property upkeep and unexpected repairs can be costly.

Liquidity Issues: Selling a rental property quickly can be challenging, limiting your access to cash.

Administrative Burden: Various legal, compliance, tax, maintenance and tenant records must be maintained.

The Cost of Owning a Rental Property

Understanding the costs involved in owning a rental property is crucial. These include:

Landlord Insurance: Higher than standard homeowner insurance.

Council Taxes: Vary by location.

Maintenance and Repairs: Regular upkeep and emergency repairs.

Property Management Fees: Typically 10-15% of the monthly rent, but this varies.

Vacancy Costs: Budget for periods when the property may be unoccupied.

Investment Property Financing Options

When buying a rental property, consider the following financing options:

Buy-to-Let Mortgages: Specifically designed for rental properties, requiring a larger deposit and higher interest rates.

Bridging Loans: Short-term loans used to bridge the gap between buying and selling properties.

Commercial Mortgages: Suitable for multi-unit properties or commercial property investments.

Personal Savings or Equity Release: Using personal funds or releasing equity from existing properties.

How to Calculate Rental Property ROI

Calculating the return on investment (ROI) for a rental property involves:

Annual Rental Income: Total rent received in a year.

Annual Expenses: Including mortgage payments, taxes, insurance, and maintenance.

Net Operating Income (NOI): Annual rental income minus annual expenses.

Cash-on-Cash Return: NOI divided by the total cash investment.

Steps to Buying a Rental Property

Choose the Right Location: Research areas with strong rental demand and potential for property value appreciation.

Save for a Deposit: Aim for a substantial deposit to secure better mortgage terms.

Get Pre-Approved for a Mortgage: Obtain pre-approval to understand your budget and demonstrate seriousness to sellers.

Make an Offer and Conduct Due Diligence: Inspect the property, verify rental income, and review all legal documents.

Consider Property Management: Hiring a property manager can simplify tenant management and maintenance.

Tips for Success in Property

Educate Yourself: Stay informed about market trends, financing options, and legal requirements.

Build a Strong Team: Work with experienced professionals, including estate agents, mortgage brokers, property managers and your financial advisor.

Analyse the Numbers: Thoroughly assess the potential ROI and financial feasibility of each investment.

Maintain a Long-Term Perspective: Property investing is typically a long-term strategy, requiring patience and persistence.

Prioritise Cash Flow: Focus on properties that generate positive cash flow from the start.

Stay Compliant: Ensure you understand and adhere to local landlord-tenant laws and regulations.

Stay Organised: Keep records of agreements, compliance certificates, inspection and maintenance records and important contacts.

Investing in buy-to-let properties is a significant financial decision that requires careful planning and diligent management. Stronghold’s secure system is designed to help you organise important property documents and information to simplify the process of purchasing and maintaining a property.

Sign up for Stronghold today and take the first step on your investment property journey. Stronghold’s intuitive interface and features ensure that important documents, information and contacts are always accessible. It’s the ultimate tool to manage important records for all of your valuable assets.

Conclusion

Investing in buy-to-let properties in can be a powerful way to build wealth and generate passive income. Leveraging tools like Stronghold can help you manage all of the important information that comes with investing in property. By understanding the process, staying organised and making informed decisions, you can maximise your chances of success.

Note: This blog post is for general informational and educational purposes only and should not be construed as legal, financial or tax advice. The content of this post is not a substitute for specific legal, financial or tax advice or any other professional services. We strongly encourage you to consult with a qualified solicitor, tax professional, financial advisor or other relevant expert before taking any action.